2021 started with a bang though as more and more people sought to get a home. This is generally how wholesalers find their deals but instead of wholesaling the house for your margin you are keeping it for yourself and achieving the 2 a month value. Average profit margin apartment building.

Average Profit Margin Apartment Building, This is generally how wholesalers find their deals but instead of wholesaling the house for your margin you are keeping it for yourself and achieving the 2 a month value. Profit Margins in Building. For example the gross profit margin for custom home builders in 2018 was 19 to 20 which rose to 21 to 23 in 2019.

It S An Optimal Time For Converting Hotel Assets To Multi Family Building From building.ca

It S An Optimal Time For Converting Hotel Assets To Multi Family Building From building.ca

How To Invest in Apartment Buildings. On a building producing 500000 in rent a 5 percent management fee would add up to 25000 a year. Retail 287 Apartment 237c. For example a twenty-unit property should deliver around 2000 per month in positive cash flow.

Typical profit that self builders can enjoy is 25.

At the end of the week month and year the profit margin is the number of dollars that will find its way into your pocket. If you have ever wanted to add an apartment building to your investment portfolio you may have wondered how to begin. The Margin on the raw materials like sand bricks cement is about 2025 percent and it varies from place to place and season to season. How To Invest in Apartment Buildings. Counter and Rental Clerks. As a general rule of thumb a 10 net profit margin is considered average a 20 margin is good and a 5 margin is low.

Read another article:

Source: eyeonhousing.org

Source: eyeonhousing.org

Management fees vary greatly but typically fall in a range between 3 percent and 7 percent of the rent collected. Stating that you buy homes fast. The figure below puts these margins in historical perspective. Counter and Rental Clerks. How Much Does The Average Remodeler Earn In A Year Eye On Housing.

Source: forbes.com

Source: forbes.com

Builders reported an average of 162 million in revenue for fiscal year 2014 of which 132 million or 811 of revenue was spent on cost of sales ie. There are many variables which need to be taken into account to comment on profit margins such as the size and type of project the type of contract the overheadsadministrative structure of the builder number of sales and other staff employed the economic state of the industry whether renovations or new housing. In our portfolio we average around 100 to 150 profit per unit per month depending upon what market the asset is located and how much debt is on the asset. Net Profit Margin Net Income Revenue x 100. How Much Money Can You Make From Buying An Apartment Building.

Source: thekickassentrepreneur.com

Source: thekickassentrepreneur.com

Current and historical gross margin operating margin and net profit margin for Apartment Investment And Management AIV over the last 10 years. Then came a painful housing recession that drove it to 144 in 2008. The 2 are going to be achieved by you putting out bandit signs newspaper ads etc. Net Profit Margin Net Income Revenue x 100. What Is The Average Profit Margin For A Small Business In North America The Kickass Entrepreneur.

Source: jakeandgino.com

Source: jakeandgino.com

Operating Profit Margin Operating Profit Revenue x 100. Management fees vary greatly but typically fall in a range between 3 percent and 7 percent of the rent collected. Net Profit Margin Net Income Revenue x 100. The difference between 3 and a 17 net profit margin on revenues of a 1 million company is the difference between 30000 and 170000 or an additional 140000 in your pocket. How Much Money Do Apartment Building Owners Make Jake Gino.

Source: assetsamerica.com

Source: assetsamerica.com

For example the gross profit margin for custom home builders in 2018 was 19 to 20 which rose to 21 to 23 in 2019. The ideal profit margin is between 16 and 20 on development costs. In 2006 builders average gross margin stood at 208. Building Cleaning and Pest Control Workers. Owning An Apartment Complex Profitability Pros Cons.

Source: realpage.com

Source: realpage.com

In our portfolio we average around 100 to 150 profit per unit per month depending upon what market the asset is located and how much debt is on the asset. Building and Grounds Cleaning and Maintenance Occupations. If you have ever wanted to add an apartment building to your investment portfolio you may have wondered how to begin. This is generally how wholesalers find their deals but instead of wholesaling the house for your margin you are keeping it for yourself and achieving the 2 a month value. Exploring The Noi Profit Margin Cycle Rp Analytics.

Source: scmp.com

Source: scmp.com

Management fees vary greatly but typically fall in a range between 3 percent and 7 percent of the rent collected. Building Cleaning and Pest Control Workers. Retail 287 Apartment 237c. Stating that you buy homes fast. Chinese Developers To Focus On Debt Reduction Until 2023 To Meet Three Red Lines Deadline South China Morning Post.

Source: realpage.com

Source: realpage.com

Management fees vary greatly but typically fall in a range between 3 percent and 7 percent of the rent collected. On average builders enjoyed US164 million in revenue for fiscal year 2017 of which 133 million or 81 was spent on cost of sales and another US19 million or 11 on operating expenses. Less than 15 of the projects recorded in the survey had build and land costs higher than the estimated market value of the finished home. In our portfolio we average around 100 to 150 profit per unit per month depending upon what market the asset is located and how much debt is on the asset. Size Matters Multifamily Apartment Building Operating Expenses Per Unit.

Source: scmp.com

Source: scmp.com

The figure below puts these margins in historical perspective. In very challenged areas it could be up to 50. Retail 287 Apartment 237c. Profit Margins in Building. Chinese Developers To Focus On Debt Reduction Until 2023 To Meet Three Red Lines Deadline South China Morning Post.

Source: theresabradleybanta.com

Source: theresabradleybanta.com

We call that margin on costs or return on costs. The difference between 3 and a 17 net profit margin on revenues of a 1 million company is the difference between 30000 and 170000 or an additional 140000 in your pocket. The ideal profit margin is between 16 and 20 on development costs. Because of the slow economy in 2020 this range dropped to 15-18 during the year. What Are Typical Apartment Building Operating Expenses.

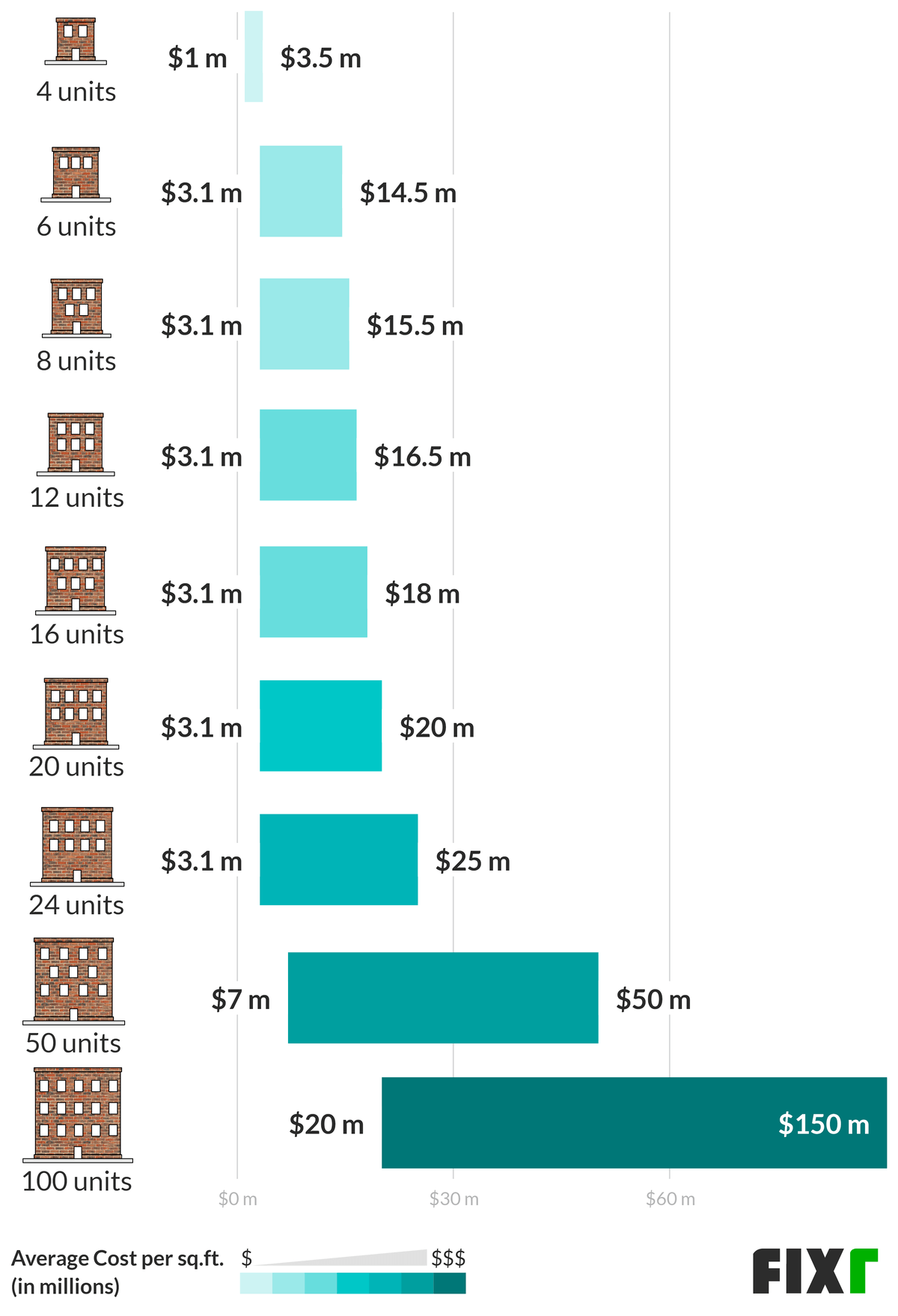

Source: fixr.com

Source: fixr.com

2021 started with a bang though as more and more people sought to get a home. As a result the industry average gross profit margin for 2017 was 190 while the average net profit margin reached 76. This refers to your profit as a percentage of your total cost. Third in terms of net profit margins retail and apartment performance stand out. 2021 Cost To Build An Apartment Apartment Building Construction Cost.

Source: jakeandgino.com

Source: jakeandgino.com

As a result the industry average gross profit margin for 2017 was 190 while the average net profit margin reached 76. Land costs direct and indirect construction costs thus leaving them with a gross profit margin of 189 31 million. Some apartment owners manage their own buildings. Sales and Related Occupations. How Much Money Do Apartment Building Owners Make Jake Gino.

Source: berkeleyside.org

Source: berkeleyside.org

Apartment Investment And Management net profit margin as of June 30 2021 is 0. If you manage the building yourself you can reduce that expense. Stating that you buy homes fast. Net Profit Margin Net Income Revenue x 100. Developer Proposes 17 Story Apartment Building Across From Uc Berkeley.

Source: bdcnetwork.com

Source: bdcnetwork.com

Profit Margins in Building. The ideal profit margin is between 16 and 20 on development costs. Operating Profit Margin Operating Profit Revenue x 100. Retail 287 Apartment 237c. Architecture And Engineering Profit Margins Deliver Third Consecutive Year Of Growth Building Design Construction.

Source: coconstruct.com

Source: coconstruct.com

Building Cleaning and Pest Control Workers. On a building producing 500000 in rent a 5 percent management fee would add up to 25000 a year. 2021 started with a bang though as more and more people sought to get a home. Builders reported an average of 162 million in revenue for fiscal year 2014 of which 132 million or 811 of revenue was spent on cost of sales ie. Home Builder Profit Margins Grew In 2020 With A Surge In Demand Coconstruct.